Institutional Flow Structuring

for private trusts

and capital issuers

Sapphire Capital Holdings specializes in monetization, redirection, and structured issuance of trust-backed financial instruments.

sapphire capital holdings

Sapphire Capital Holdings is a private financial operations firm focused on institutional-grade flow structuring, IBOE issuance, custodial reassignments, and trust monetization strategies.

We help private trusts, foundations, and flow participants reclaim or redirect value through proprietary financial instruments and enforcement-grade frameworks.

Frequently Asked Questions

What is flow structuring and how does it work?

Flow structuring is the process of designing legal and financial instructions that redirect securitized value into a designated account, typically through custodial participation or DTC clearing.

Can Sapphire help me monetize trust-backed instruments?

Yes — we specialize in private trust liquidity and custodial redirection.

Do I need to be a licensed investor to engage your services?

We work with both accredited institutions and private trustees acting under lawful authority.

Testimonials

Private Trust Issuer

“The institutional format, compliance, and yield forecasting provided by Sapphire put us years ahead of the market.”

Flow Recovery Partner

“Their enforcement support and custodial coordination were flawless.”

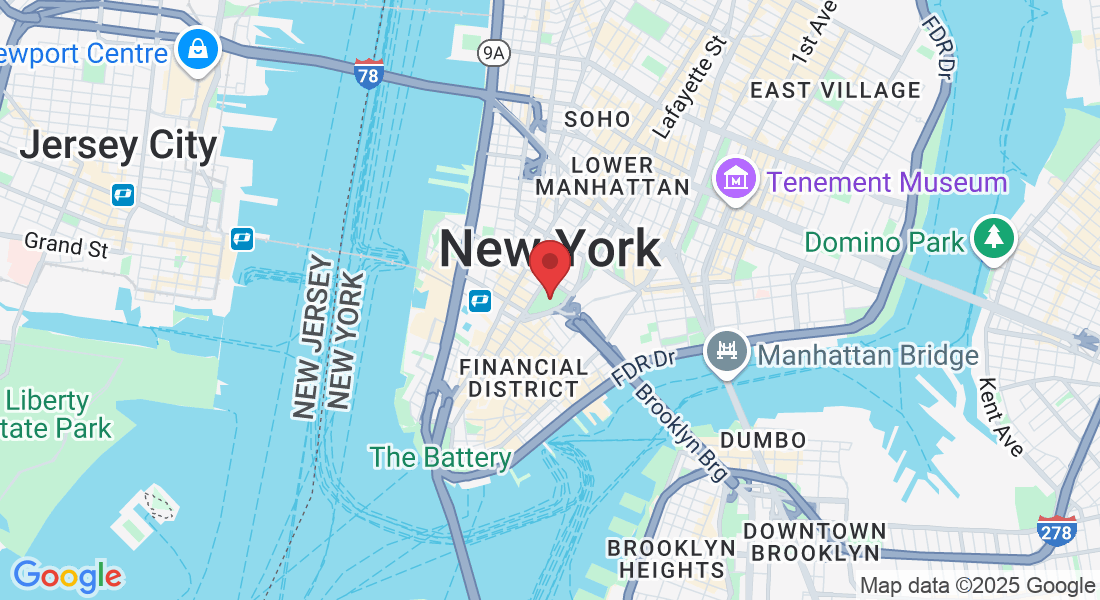

14 Wall Street

20th Floor

New York, New York 10005 USA